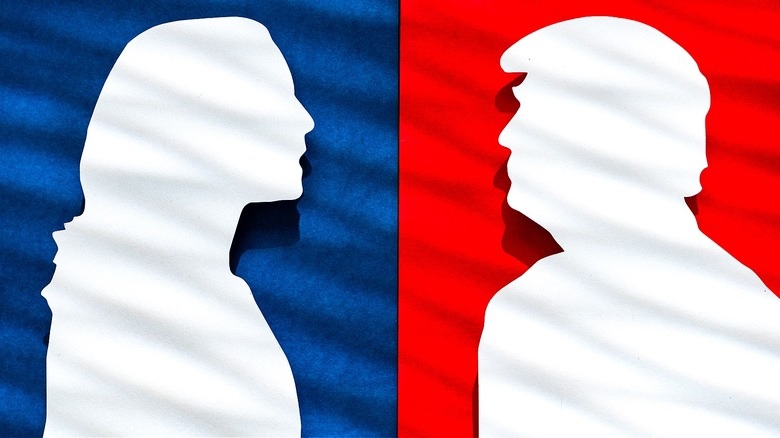

Where Trump and Harris stand on Social Security funding

The trust fund financing Social Security benefits for 51 million retired workers and 6 million survivor beneficiaries is projected to become insolvent by 2032, potentially leading to a 21% cut in benefits, according to the Committee for Responsible Federal Budget. Concerns over possible reductions in Social Security checks have made the topic one of the most searched issues this election cycle.

Both former President Donald Trump and Vice President Kamala Harris have pledged to protect Social Security benefits; however, neither has presented a comprehensive plan to address the projected $23.2 trillion funding shortfall over the next 75 years. Changes to the Social Security Act will require congressional action, although the president can influence Congress's approach.

Trump has rejected suggestions from the Republican Study Committee to raise the retirement age or cut benefits. Instead, he has proposed eliminating taxes on Social Security benefits, a move that tax expert Garrett Watson criticizes as unsound, estimating it could reduce revenue by $1.4 trillion from 2025 to 2034 and hasten insolvency. Trump has also suggested funding Social Security through oil and gas sales, a proposal deemed insufficient by the Committee for a Responsible Federal Budget.

On the other hand, during a recent presidential debate, Biden advocated eliminating the cap on payroll taxes, currently set at $168,600, while suggesting additional taxes on income above $400,000. An analysis found that implementing this plan could extend the trust's solvency by approximately 32 years. As a senator, Harris co-sponsored the Social Security Expansion Act, which sought to reinstate payroll taxes on income exceeding $250,000. With over 50 million beneficiaries potentially at risk, bipartisan pressure is mounting to ensure the program's sustainability.